As the column contains the amount received so, this has to be changed for every new cash receipt issued by the company. In this column, the amount received from the customer is to be entered in the numbers. As the column contains the name of the party so, this has to be changed for every new cash receipt issued by the company. The company may decide to add the address of the customer as well according to its wish. It is one of the most important columns of the template, as will contain the name of the party. Under this name of the person from whom the amount has been received is to be entered.

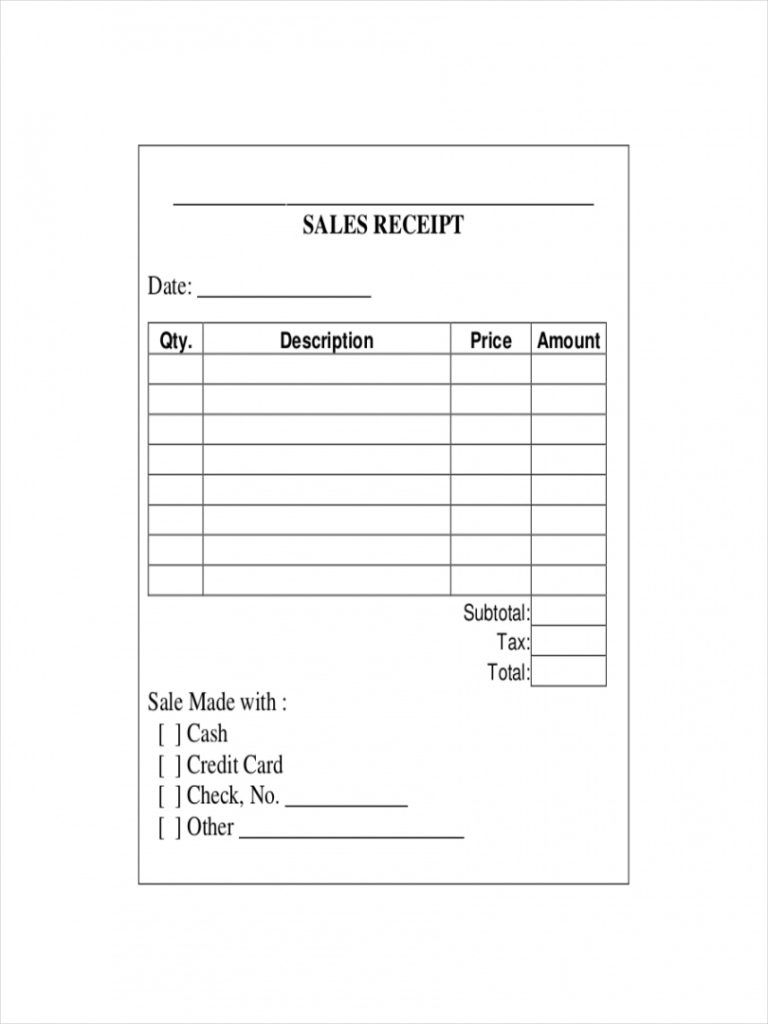

So, this has to be changed for every new cash receipt issued. At the end of any accounting period, reconciliation involves matching balances and ensuring that debits (credits) from one account for one transaction is same as the credit (debits) to another account for the same transaction. With the help of this, the company would be able to keep the record of the cash receipts issued, and also it will help in doing the reconciliation Reconciliation Reconciliation is the process of comparing account balances to identify any financial inconsistencies, discrepancies, omissions, or even fraud. So, this has to be changed daily.įor every Cash receipt issued by the company against the receipt of the cash from its customer, a unique receipt number should be allotted. This column is necessary to keep track of the payment made by the customer date wise, as the company should know the date when the client paid. Under this column, the user has to enter the date on which the cash receipt is issued to the customer. So, the details under this heading will remain intact, and the user needs not to change unless required. It has to be filled once by the template user unless there are any changes in the company’s name or place of business. Under this heading, the company has to enter its registered name and address. This heading will remain intact and will not be changed. It is written to give a clear understanding to the user of the template that the template pertains to the cash receipt. Componentsįollowing are the different details that are present generally in the cash receipt template: #1 – Heading:Īt the topmost area of the cash receipt, the heading cash receipt will be written. It reduces the repetitive work for every new cash receipt. It has settings that store all details of the company to the extent possible, along with formulas, which get automatically populated on the receipt. Many companies set the cash Receipt template. read more template is set by many of the company which has Settings that stores all details of the company to the extent possible along with the formulas which get automatically populated on the receipt, thereby reducing the repeating of the work for every new cash receipt. The original copy of this receipt is given to the customer, while the seller keeps the other copy for accounting purposes. When the company receives the cash from its customers, then it has to give the acknowledgment of the same to its customer duly signed by the authorized person showing the various details of the payment that includes the details of business issuing the cash receipt, name of the party to whom cash receipt is given, details of amount and mode of payment and the details of the balance of the customer account and for this purpose Cash Receipt Cash Receipt A cash receipt is a small document that works as evidence that the amount of cash received during a transaction involves transferring cash or cash equivalent.

0 kommentar(er)

0 kommentar(er)